Sustainable Microfinance: Bridging the Gap to Financial Services for the Marginalised while Minimising the Environmental Impact

What is sustainable microfinance and why is it needed?

To understand the concept of sustainable microfinance, we should first look at microfinance.

Microfinance provides small-scale loans, savings accounts, insurance, and other basic financial services to low-income individuals or groups who typically lack access to traditional banking services. It is designed to help people who are often excluded from the formal financial sector, such as the poor, marginalised, and those in rural areas, to access financial resources to improve their livelihoods and support small business ventures. Microfinance loans tend to be much smaller than a traditional bank loan and aim to empower individuals and communities by providing access to capital income-generating activities like starting or expanding a small business. It can play a significant role in poverty reduction and economic development in the developing world by giving people the tools they need to create new, sustainable livelihoods.

Sustainable microfinance follows the same principles as microfinance in a way that is economically, socially, and environmentally sustainable. It aims to help people with limited access to traditional banking services while focusing on long-term viability and positive social and environmental impact. Sustainable microfinance is important because it not only addresses poverty and financial inclusion but also recognises the critical role that environmental and social factors play in community development and the long-term success of microfinance programs. In a world increasingly affected by climate change, sustainable microfinance encourages the development of businesses that are more resilient to environmental challenges which can help vulnerable communities reduce their exposure to environmental risks. This is particularly important in areas prone to extreme weather and natural disasters, as it can help communities rebuild and recover more effectively.

What are some examples of sustainable microfinance?

Sustainable microfinance is most commonly seen in the form of “green loans”, which are loans specifically for the setup or growth of eco-friendly businesses such as renewable energy installations, organic farming, or sustainable forestry. These loans actively promote environmental sustainability while supporting entrepreneurship. Similarly, eco-friendly agriculture (or eco-agri loans) provides loans and technical support to small-scale farmers to adopt sustainable farming practices, such as organic farming, agroforestry, or integrated pest management. Sustainable agriculture is an important part of the fight against climate change by reducing pollution, conserving water and soil resources, protecting biodiversity, and reducing the degradation of the natural environment all to help maintain the long-term health of ecosystems. Finally, sustainable microfinance could include microinsurance products to help protect clients against climate-related risks, such as crop failure due to extreme weather events. This helps vulnerable individuals and communities recover from environmental disasters and build resilience within small businesses.

What is Grameen Microfinance?

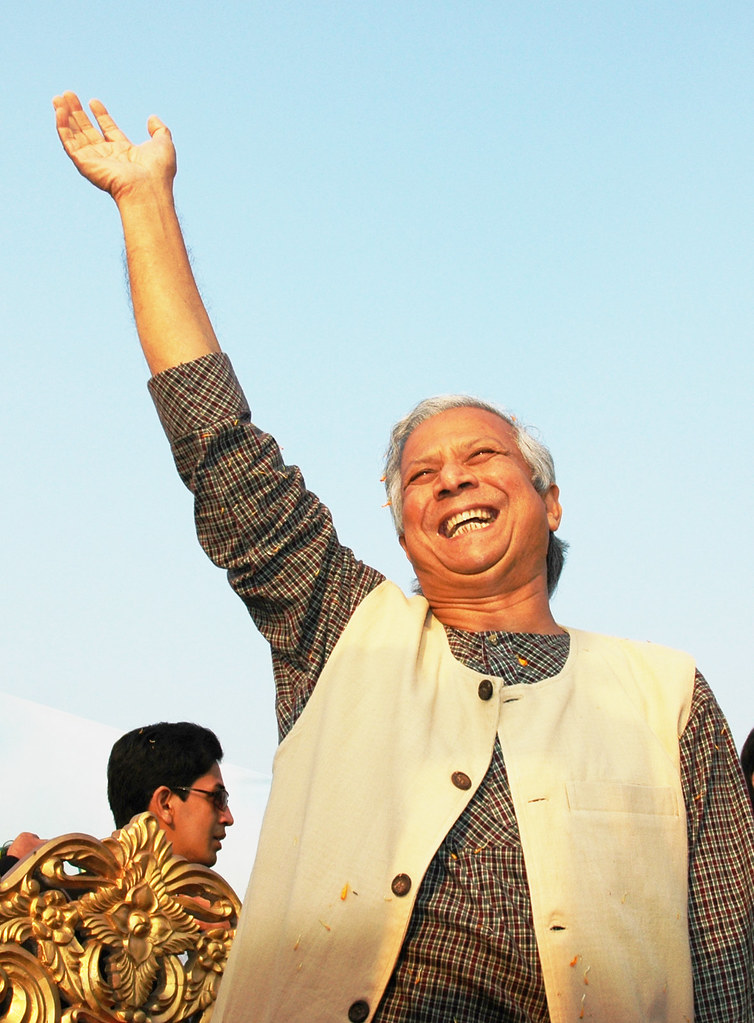

Perhaps the most well-known model of microfinance, the Grameen Bank was founded by Nobel Peace Prize winner Professor Muhammad Yunus in Bangladesh in 1983. The primary mission is to provide financial services to the poorest and most marginalised individuals, especially women, who would otherwise have no access to credit to address financial exclusion and poverty. The term “Grameen” means “rural” in Bengali to reflect the focus on serving rural communities.

Unique features and principles of Grameen microfinance include:

- Group lending model, where borrowers form small groups and members are collectively responsible for each other’s loans to foster a sense of community and social support among borrowers.

- Microloans of very small amounts which are typically used to start or expand small businesses, such as farming, handicrafts, or trading.

- Empowering women economically is a key focus of Grameen Bank with a significant portion of its borrowers being women. This has been shown to have positive impacts on gender equality and women’s social and economic status.

- Unlike most financial institutions, Grameen Bank does not require borrowers to provide collateral or guarantees for their loans, relying instead on “social collateral,” where the trust among borrower groups serve as the basis for loan approval.

- Low interest rates compared to alternative lending sources and frequent repayment schedule designed to instil financial discipline and help borrowers manage their loans effectively.

Grameen Bank’s success in providing financial services to impoverished communities has inspired the development of similar microfinance institutions around the world, including Dana Asia’s partner Grameen Pilipinas Microfinance Inc. (GPMI) . It has demonstrated that microfinance can be a powerful tool for poverty alleviation and that even very small loans, when used effectively, can have a significant impact on the economic potential of low-income individuals and communities.

What part does Dana Asia play in sustainable microfinance?

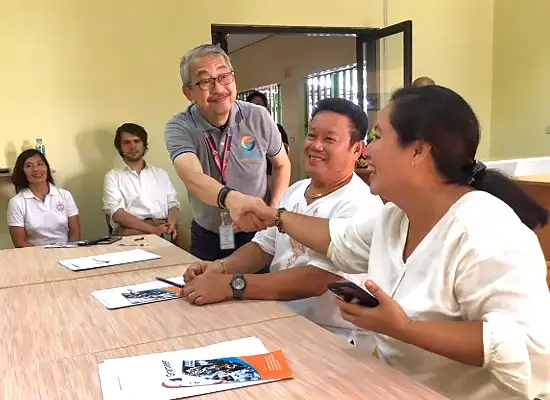

Dana Asia works in partnership with Grameen Pilipinas Microfinance Inc. (GPMI), based in Manila, Philippines, to develop innovative new sustainable loan products for the startup of new businesses that are environmentally aware as well as socially impactful and economically viable. Inspired by Professor Yunus and the Grameen Bank, GPMI’s aim is to be “The hub of microfinance in nurturing families to uplift themselves, contribute to their local economy, and take care of the planet”. With this in mind, Dana Asia supports GPMI to promote environmental sustainability within member businesses through specific sustainable microfinance products and developing strategies for the GPMI team to deliver on the ground.

One example is the eco sari-sari store microfinance product that is currently in development. Sari-sari stores are small convenience stores found on every street corner in the Philippines. The majority of products are sold in plastic sachets, targetting low-income customers who can only afford to purchase in tiny amounts. These sari-sari stores contribute significantly to the 163 million sachets used in the Philippines each day, most of which are not recycled and end up in waterways or landfill. For many years, sari-sari stores have been the primary business type of GPMI clients. Dana Asia and GPMI have developed a microfinance product that provides store owners with the capital to replace some of the most commonly-bought items, such as cooking oil and coffee, with refill alternatives. Sari-sari store owners might start with just one refill product but over time would grow to replace more and more for increased environmental impact. Products are bought in bulk by the shop owner and sold with a bring-your-own-container approach not only reducing the amount of plastic generated by also increasing profit margins for store owners while lowering the cost of basic goods for low-income consumers.

Sustainable microfinance: the future of microfinance

One thing the world can agree on is that taking responsibility for the environmental impact of what we do is becoming more and more important. This applies to us as individuals but even more so to businesses. It is therefore essential that new and growing businesses take into account the sustainability of their ventures, big or small. Sustainable microfinance enables impoverished or otherwise marginalised microentrepreneurs to establish income-generating businesses vital for the survival of their families while minimising damage to the environment In time, we at Dana Asia hope to see more and more microfinance institutions prioritising loans to businesses that are able to demonstrate their active participation in the protection of the planet and advancement of society.