Sustainable Microfinance

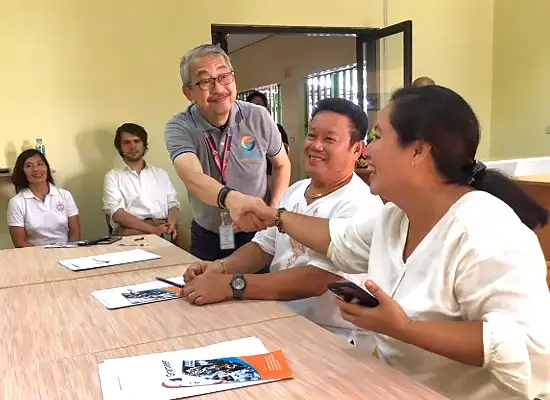

Partnered with Grameen Pilipinas Microfinance Inc, Grameen-style microfinance with training and mentorship helps small business owners to start and grow businesses as a way out of poverty.

Through partner Grameen Pilipinas Microfinance Inc, we give aspiring entrepreneurs in the Philippines an opportunity to establish and grow successful businesses, combining microfinance with training and mentoring to ensure long-term success.

Grameen Pilipinas Microfinance Inc (GPMI) models its approach after the teachings and successes of Nobel Laureate Professor Muhammad Yunus and the Grameen Bank of Bangladesh, targetting the poorest of the poor and playing on their strengths to become successful micro-entrepreneurs.

Marginalised communities are often excluded from mainstream micro-financing and other services, meaning they never get the opportunity to reach their full business potential. Dana Asia seeks to reduce social inequalities to bring equal opportunities to all, regardless of background.

GPMI strives to become a leader in “green microfinance”. Dana Asia works with GPMI to develop innovative new sustainable loan products for the startup of new businesses that are environmentally aware as well as socially impactful and economically viable. Some examples are eco agri loans for sustainable agribusinesses and the eco sari-sari store loan that aims to reduce the plastic waste created by GPMI sari-sari store client businesses.

Will you help small business owners in the Philippines get out of poverty?

US$1,500

gives 10 aspiring micro-entrepreneurs the microfinance capital they need to launch a small business..

Microfinance Success Stories

We empowered several small entrepreneurs to grow their businesses through microfinance, financial management, and business training.

Sustainable Microfinance: The Journey Of A Woman Entrepreneur Leading The Zero Waste Revolution

The Philippines plays a considerable role in the global plastic waste crisis. The Philippines is the number one contributor…

Maria Cecilia family sari-sari store owner expands capacity through microloans

Cecilia is from Pagsanjan in the province of Laguna, south of Metro Manila. This is where she met her…

Rags to riches: Meet Marife Andales Samarita

Marife Andales Samarita is a shining example of a microentrepreneur who has turned her small, home-based business into a…