From microfinance to microenterprise in just three loan cycles

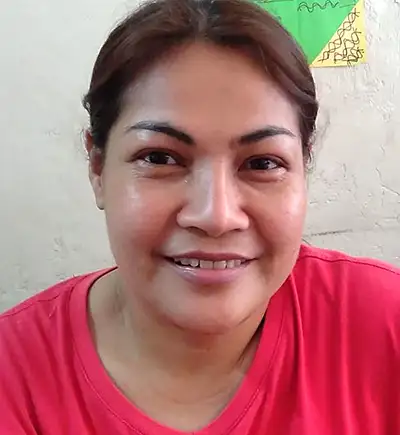

Apolinaria Gracia, or Nanay Poleng as she is fondly known, is 59 years old, a mother of two and lives with her husband Joven in Rizal, Philippines. When you first meet her, she appears shy, but don’t let this fool you – she is an incredibly determined entrepreneur.

Her husband farms a small piece of land near where they live but their income from this has become very unpredictable due to the effects of global warming on crop potential. To give them another means of income, in 2015 they set up a sari-sari convenience store to start selling basic grocery items. The store is almost 15km from their home and is named after their first grandchild, ‘Yan Yan’.

In 2017, Nanay Poleng’s family faced a great tragedy when one of her children was killed in a motorcycle accident. This devastating event made the whole family pause and reflect on their lives. Nanay Poleng decided she wanted to make a change and give her family a new focus. She became a member of Grameen Pilipinas Microfinance Inc in 2018 and applied for her first loan of PHP 7,000 PHP to enable her to take her sari-sari store to the next level by adding bottled beverages to her line of retail products.

After a second loan of the same amount and maintaining a good credit standing throughout, Nanay Poleng transitioned from a microfinance client to a micro-enterprise client on her third loan cycle, which meant she was able to secure a larger loan of PHP 30,000. With this injection of capital, she was able to evolve the business into a wholesale trader of bottled beverages. She purchased a second-hand Mitsubishi van, which she used to supply other retailers in nearby communities.

When COVID-19 struck the Philippines and her community was forced into lockdown, supply chains were interrupted but Nanay Poleng’s business continued to thrive. Now in her fifth loan cycle, she intends to purchase another delivery vehicle to keep up with the demand in her network of retailers. Her entrepreneurial spirit is an inspiration to other entrepreneurs in her community, and she is a great example of how microfinance can be used to change a family’s fortune.

Social investment can give more microentrepreneurs like Nanay to upgrade their businesses. Find out how you can support at our microfinance page.