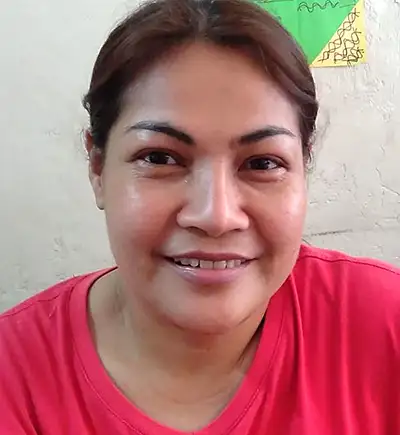

Rags to riches: Meet Marife Andales Samarita

Marife Andales Samarita is a shining example of a microentrepreneur who has turned her small, home-based business into a successful enterprise with the help of microfinance.

Want to learn more about sustainable microfinance? Read our post: Sustainable Microfinance: Bridging the Gap to Financial Services for the Marginalised while Minimising the Environmental Impact

Marife lives in East Rizal, Philippines and she is the proud owner of TGS Merchandise, a custom clothes manufacturing enterprise that has been in business for over a decade. She is also the mother of three: two of her children are working and one still in college. Born into a poor family, her parents could not afford to support her studies past secondary school but this did not dampen her drive to succeed. When she left school, she challenged the embedded patriarchal social stereotypes by becoming a tricycle driver and providing a school transport service in her community. In 2015, she learnt about Grameen Pilipinas Microfinance Inc (GPMI) and their loan offerings. At that time she was working in rag making but was struggling to make enough to support her family of five, with two children in university.

She was apprehensive of GPMI at the time – there were many microfinance institutions marketing their services in her area and she wasn’t sure which she could trust. Assurance from her friend convinced her to take the plunge and become a member. Marife became one of GPMI’s first member borrowers in Lupang Arenda, Taytay in the province of Rizal, starting with a loan of PHP 5,000.

By November 2021, she had already completed 10 loan cycles and proven to be a highly reliable member and skilled businesswoman. All loans were used to expand her business, upgrade machinery, and start new ventures to enter new market. As well as growing her business, she has been able to save some money for her children’s education, medical expenses, or any other unexpected costs. The loans have enabled her to turn her informal rag-making business into a custom clothing enterprise. She now employs four seamstresses, who rent machines from her to enable her to increase productivity.

When asked about her new team, Marife said;

“Good seamstresses are hard to come by. They also easily get pirated in the area. To protect my investment, I thought of setting up rooms for rent for my staff, so they do not have to commute going to work and leave their children behind. They get free meals during work hours as part of the terms of employment. I think this set-up is mutually beneficial.”

Marife Andales Samarita

Marife hopes to keep growing her business, employ more local women from her community, and inspire others to follow their dreams.

Marife isn’t the only female entrepreneur to break the cycle of poverty through microfinance. Meet Analen Alopoop, a zero waste sari-sari store owner that combats the plastic waste crisis and increased her income.

Inspired by Marife?

Consider donating to Dana Asia to help more people like Marife, click here and press the “Give Now” button.

Living in the Philippines as a microentrepreneur? Are you ready to take your business to the next level? You may be eligible for a microfinance loan. Like Marife, you could have access to capital and training to increase your business productivity and income potential.