What is workplace giving?

Workplace giving (WPG) enables employees to make regular donations to charitable organisations with deductible gift recipient (DGR) status directly from their pre-tax income. The employee simply chooses an amount to donate and the employer deducts the amount from your pay and sends the donation directly to the charity each payday.

What are the benefits of workplace giving?

Workplace giving offers benefits for both employees and employers, making it a powerful tool for fostering a positive corporate culture and making a meaningful impact on society. It provides employees with an easy and convenient way to support causes they care about, aligning their personal values with their professional endeavors while for employers, it demonstrates a commitment to social responsibility, enhancing the company’s reputation and attractiveness to both clients and potential employees. Engaging in philanthropic activities can also boost employee loyalty and productivity, as individuals feel a stronger connection to their workplace and its broader purpose.

Workplace giving can have a significant positive impact on communities and causes in need. By pooling resources and leveraging collective efforts, organisations can amplify their contributions to support a wide range of initiatives for real, long-term impact. Workplace giving is not only good for the employer and employee but also for society as a whole, fostering a culture of generosity, compassion, and collaboration.

What can you do?

As an employer, you can find out more about setting up a workplace giving program here.

As an employee, talk to your managers about existing workplace giving programs or enquire about setting one up. You can download this template workplace giving form to help get things started. Simply add your company’s logo and customise for your needs.

Once the program is setup, employees simply complete the WPG donation form and pass it on to their payroll office. Donations are deducted from the pre-tax salary payment and passed directly onto the chosen charity.

Why donate to Dana Asia?

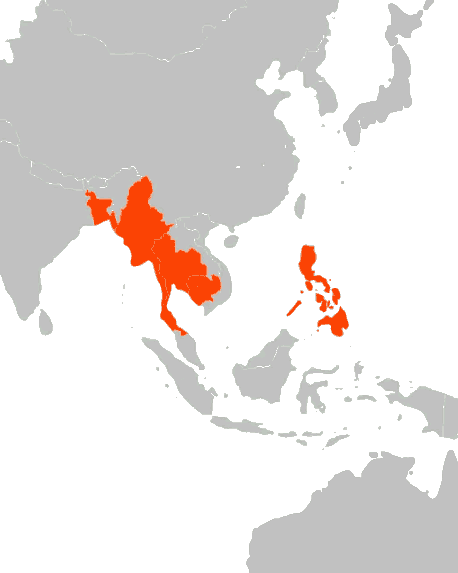

Dana Asia is experienced at collaborating with a variety of stakeholders and has worked closely with marginalised communities throughout South East Asia since 2013. Our team has a comprehensive understanding of the complex context and environment in which we work, meaning we are well-placed to consult not only on the types of social projects needed to address urgent needs within these communities, but also ensure they are sustainable long-term.