Despite COVID and typhoons, Mary Ann’s business is booming…

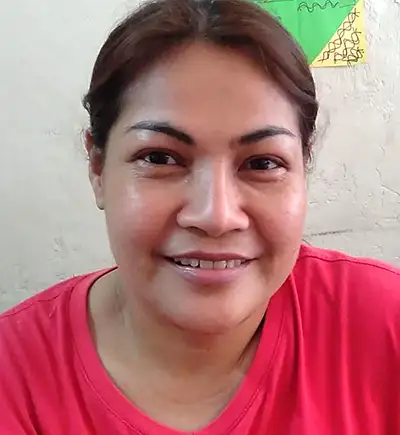

In the Philippines, 45-year-old Mary Ann has run her successful food business and retail store for more than eight years. The income she earns has helped put her three children through school, with two of them able to continue their tertiary education at the University of Santo Tomas in Manila.

While many small-to-medium scale businesses were heavily impacted by the COVID-19 pandemic, Mary Ann has worked hard and adapted well. She decided to join Grameen Pilipinas Microfinance Inc (GPMI) in October 2020, securing additional funding to add to the variety of food on offer in her store. Granted her first loan of PHP 22,500, Mary Ann planned to use the money to purchase an industrial stainless steel griddle to enable her to add fresh fried chicken and hamburgers to her daily menu, to entice her hungry customers.

In November 2020, Typhoon Ulysses caused the Marikina River to burst its banks, resulting in mass flooding. Mary Ann and her family had lived in this area for nearly 25 years but unexpectedly, the river water rose more than 18m high causing mass damage to property, livelihoods and loss of life. The typhoons caused devastation in communities already struggling to survive due to COVID-19.

Although Mary Ann and her family were determined to rise above the difficulties, the sheer extent of the damage meant considerable support was needed to get her business up and running again. To help Mary Ann get her business and life back on track, GPMI granted a six-week moratorium on her loan payments. With GPMI’s support, Mary Ann was able to slowly get her business operational again – and she is now able to repay her loan.

Mary Ann is an excellent example of the resilience and tenacity typical of GPMI borrowers: even when faced with such severe destruction in her personal and professional life, with her eyes fixed firmly on the future, she was able to recover and rebuild her successful business.

You can support microentrepreneur like Mary Ann to upgrade their businesses for a sustainable income. Visit the microfinance page to find out how.